Office Supplies and Office Expenses on Your Business Taxes

:max_bytes(150000):strip_icc()/GettyImages-137552576-1--5754396c3df78c9b46367699.jpg)

Office Supplies and Office Expenses on Your Business Taxes

Deducting office supplies and office expenses, the new simpler IRS rule for expensing rather than depreciating, and where to put on your tax return.

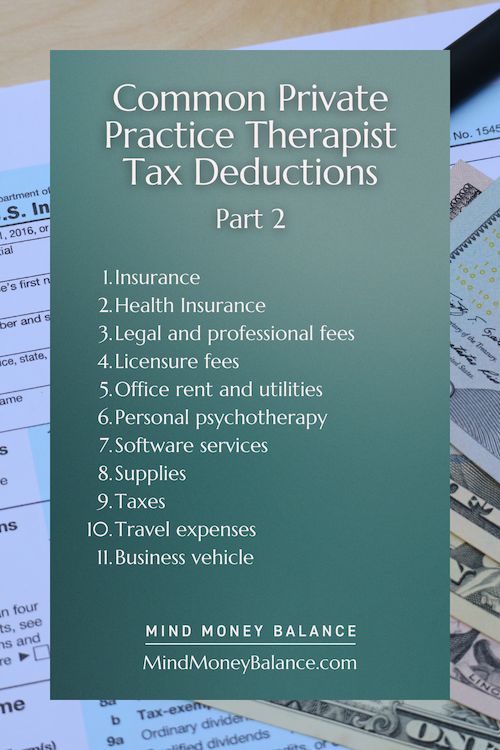

Tax Deductions for Therapists → 15 Write-Offs You Might Have Missed

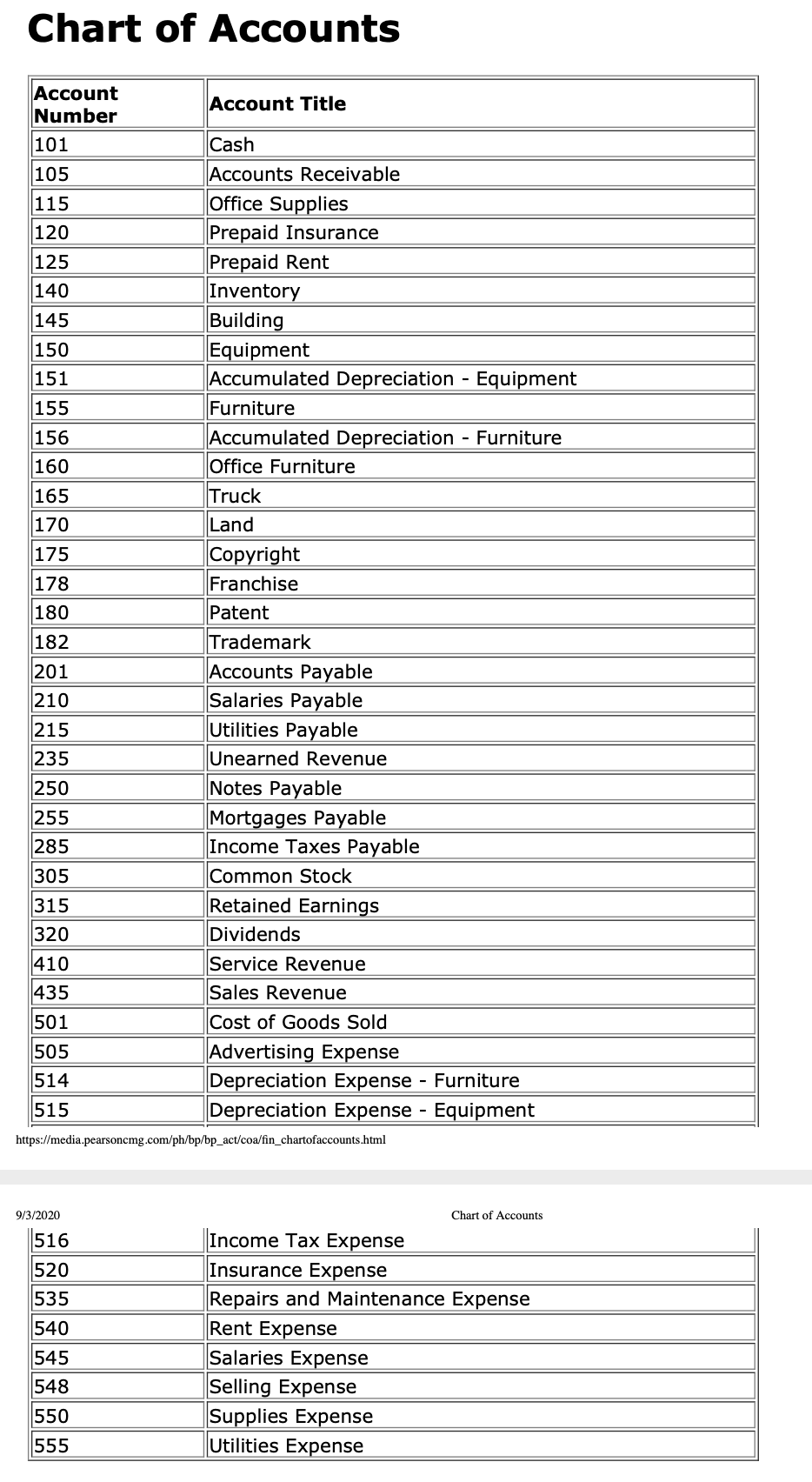

Are Supplies a Current Asset? How to Classify Office Supplies on Financial Statements

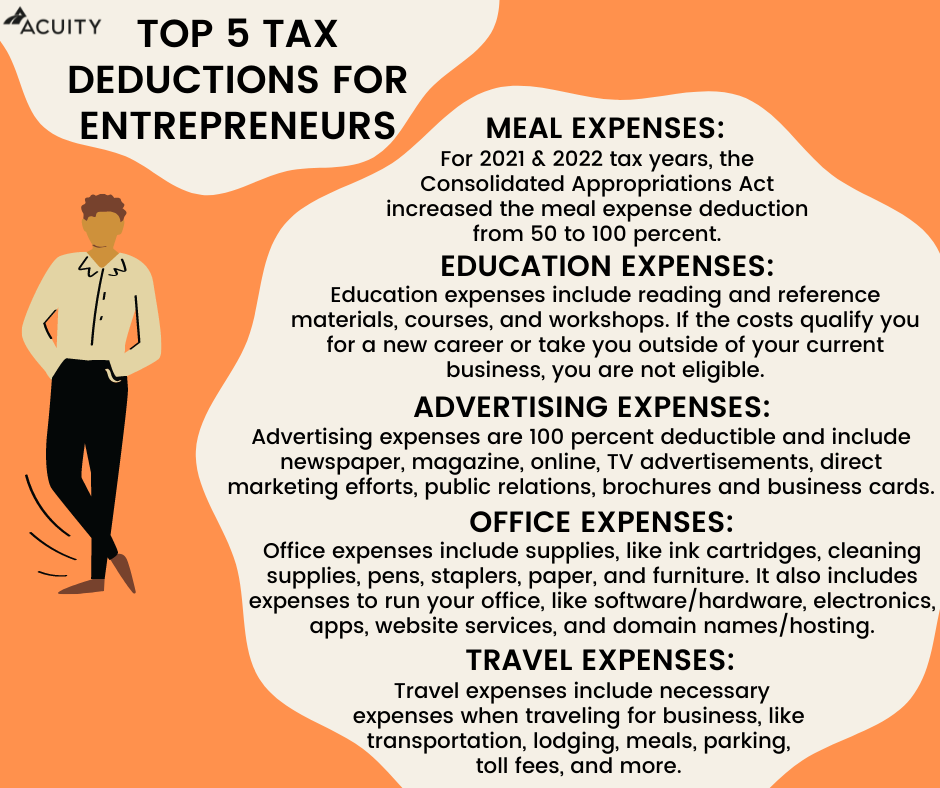

36 Business Expense Categories for Small Businesses and Startups

How to Avoid Making a Big Mistake on Your Tax Return — Taking Care of Business

17 Big Tax Deductions (Write Offs) for Businesses

Are Electronic Medical Charts Considered Office Supplies? –

14 Business Startup Costs Business Owners Need to Know - NerdWallet

25 Small Business Tax Deductions To Know in 2024

How To File And Pay Small Business Taxes

Solved Office Supplies used during the month, $90. Date

14 Small Business Expense Categories to Consider

Startup Tax Credits & Deductions You Might Be Missing

Side Hustle Taxes: Everything You Need To Know In 2024

10 Most Common Small Business Tax Deductions (Infographic)