HSA Planning When Both Spouses Have High-Deductible Health Plans

HSA Planning When Both Spouses Have High-Deductible Health Plans

Financial advisors can help couples navigate the various rules around contributing to and withdrawing from HSA plans when both spouses have high-deductible plans.

HSA or not to HSA: Dependency to High-Deductible Health Plan

What Is a Health Savings Account (HSA)? - Ramsey

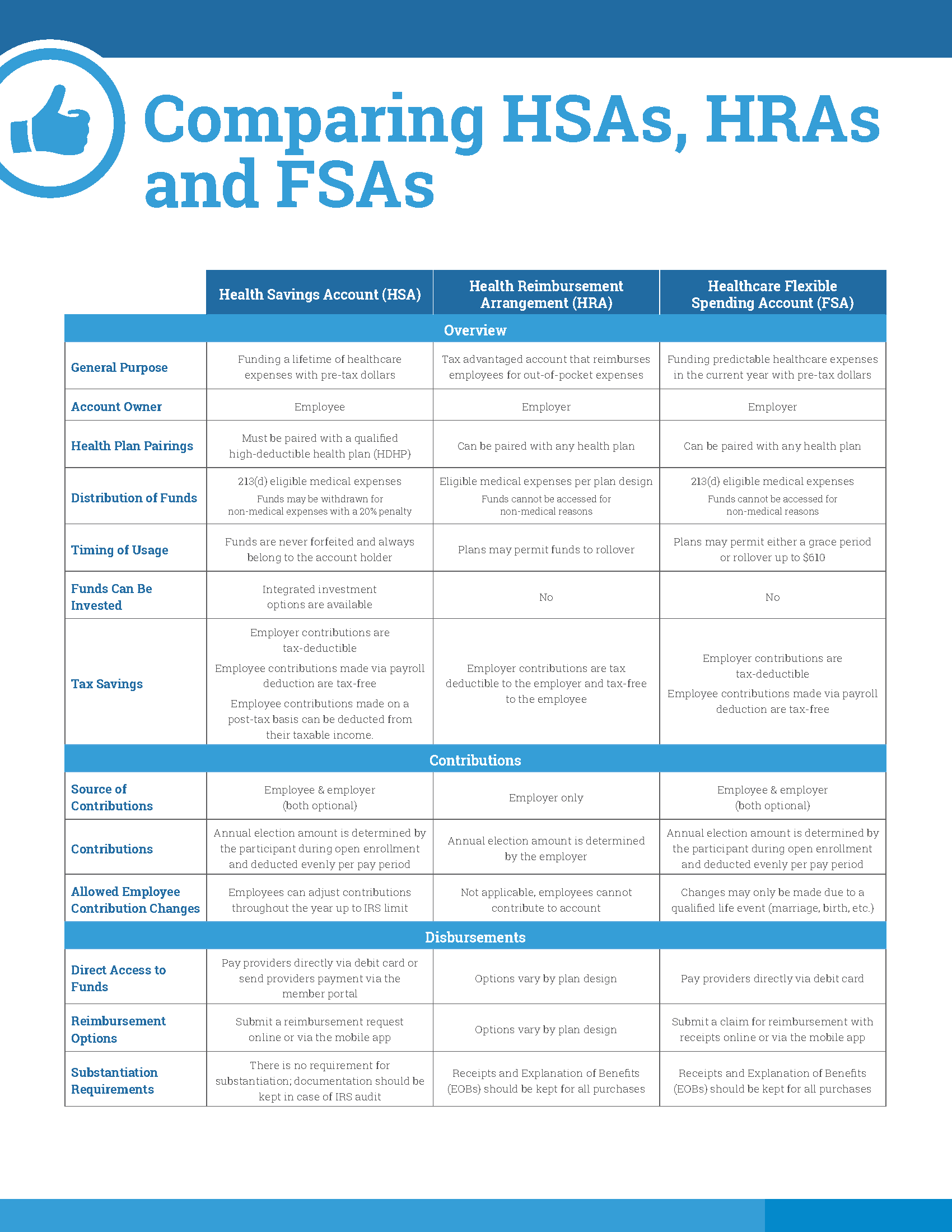

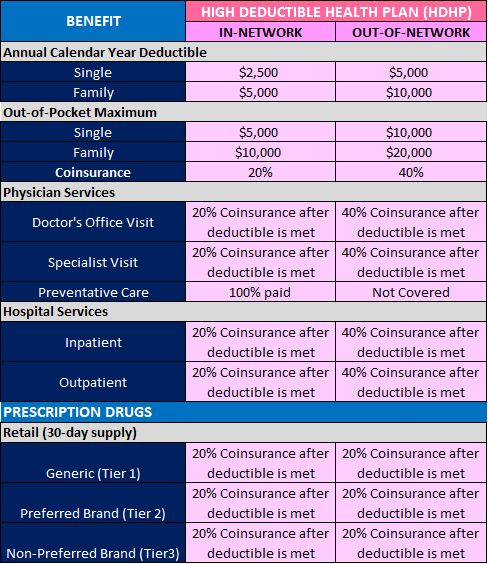

Getting to Know the HDHP & HSA

:max_bytes(150000):strip_icc()/rules-having-health-savings-account-hsa_final-58180fce30aa4fe8b278b4137e8ccb48.png)

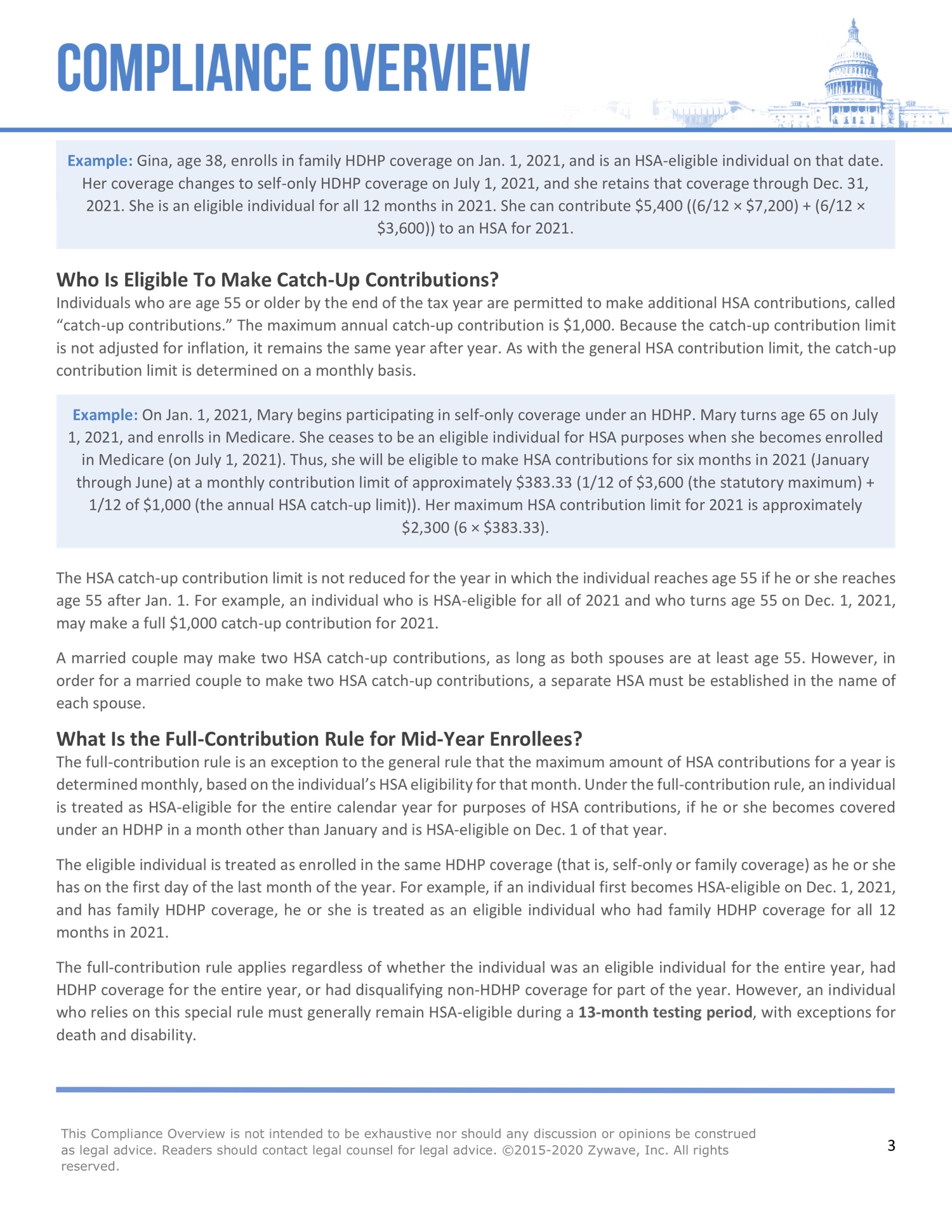

Health Savings Account (HSA) Rules and Limits

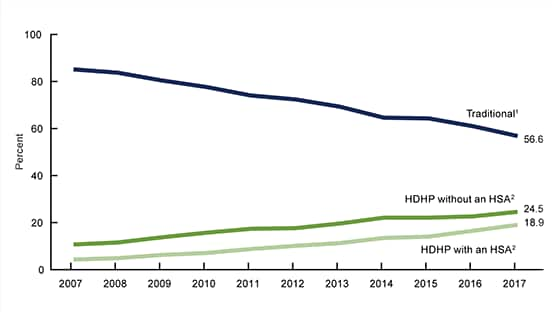

Products - Data Briefs - Number 317 - August 2018

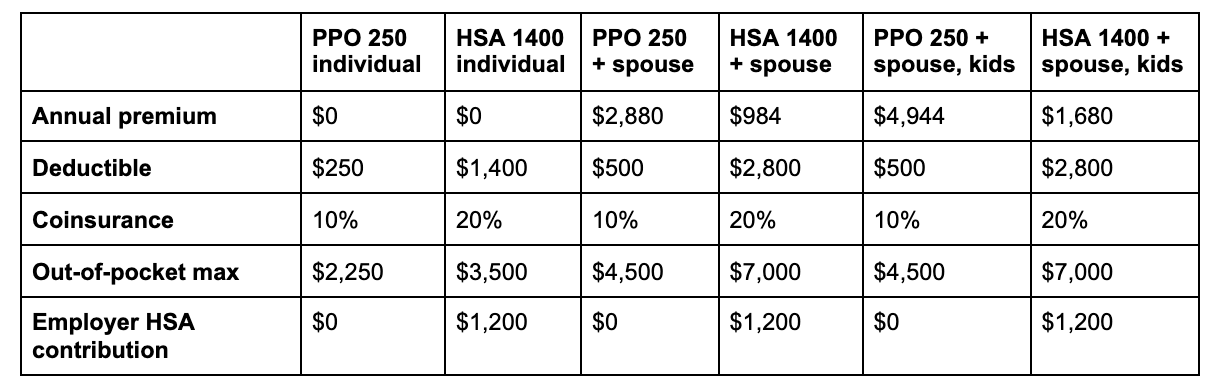

HSA-Compatible High-Deductible Health Plans

HDHP vs. PPO: What You Should Know ❘ Wealthfront

Health Savings Accounts and High Deductible Health Plans

Section 8: High-Deductible Health Plans with Savings Option

How to Make Your HSA-qualified HDHP Strategy a Success

Health Savings Account (HSA)

High deductible health plan cost & savings

High-Deductible Health Plans (HDHP) - GoodRx

IRS Makes Historical Increase to 2024 HSA Contribution Limits